M&A related advisory

In recent years, as a background to the quick response to successor issues, changes in the external and internal environment, and concentration of management resources on the company's core business, An increasing number of companies are restructuring their businesses through mergers and acquisitions (M&A).

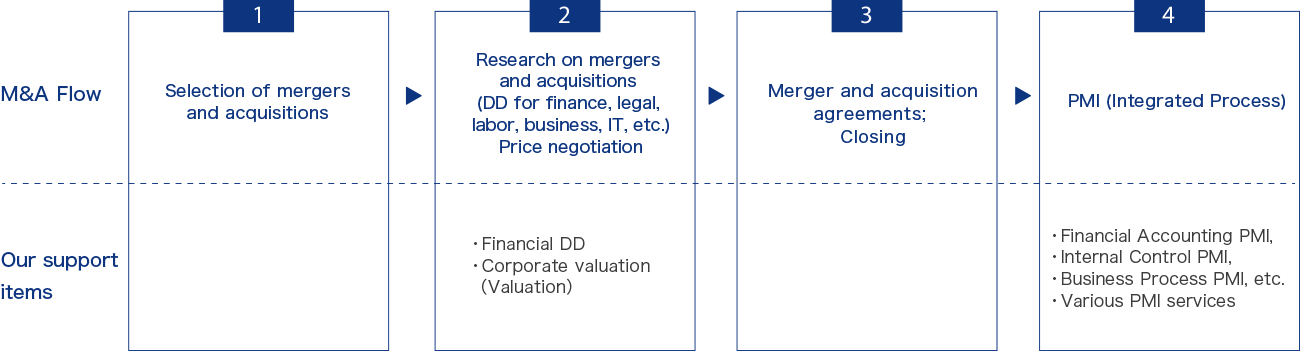

We support management strategies to enhance corporate value by providing various M&A-related support systems, such as due diligence (DD), valuation, and post-merger integration (PMI), which is the process of integrating business processes and accounting standards after the merger.

General flow of M&A and our support items (examples)

Financial DD

We conduct optimal financial due diligence according to the characteristics of mergers and acquisitions.

In addition to procedures such as hearings, financial analysis, and investigations of financial data, we conduct inspections of factories, warehouses, etc. as necessary to identify the financial risks of the acquired company and accurately organize and report the main points and issues.

Since our members have audit experience in various industries and overseas experience, we can conduct surveys and reports regardless of industry or nationality.

Valuation

Corporate valuation is extremely important in the implementation phase of M&A, etc., and we provide valuation services as a third-party accounting organization that serves as a basis for making acquisition decisions.

With experienced members, we respond to a wide range of client needs, such as valuation of corporate value (stock value), valuation of business value, and calculation of corporate restructuring (merger, share exchange, company split) ratio.

Post merger integration

PMI refers to the integration process after a merger or acquisition.

Corporate culture, sales strategies, accounting treatment, etc. vary greatly from company to company, and how to integrate these is the most important part of the merger and acquisition process.

Implementing integration operations quickly and effectively maximizes synergies after mergers and acquisitions.

We support optimal PMI from the perspectives of financial and management accounting, internal control, and corporate operations.